What you must know about crypto trading?

Cryptocurrency trading is a highly volatile and complex market, which means it’s important for any investor to have a solid understanding of the basics before getting involved. In this article, we’ll introduce you to the history of cryptocurrencies, outline the key concepts behind crypto trading, and share our top tips for success in this particular market. So, whether you’re a first-time trader or an experienced investor, read on to learn everything you need to know about crypto trading!

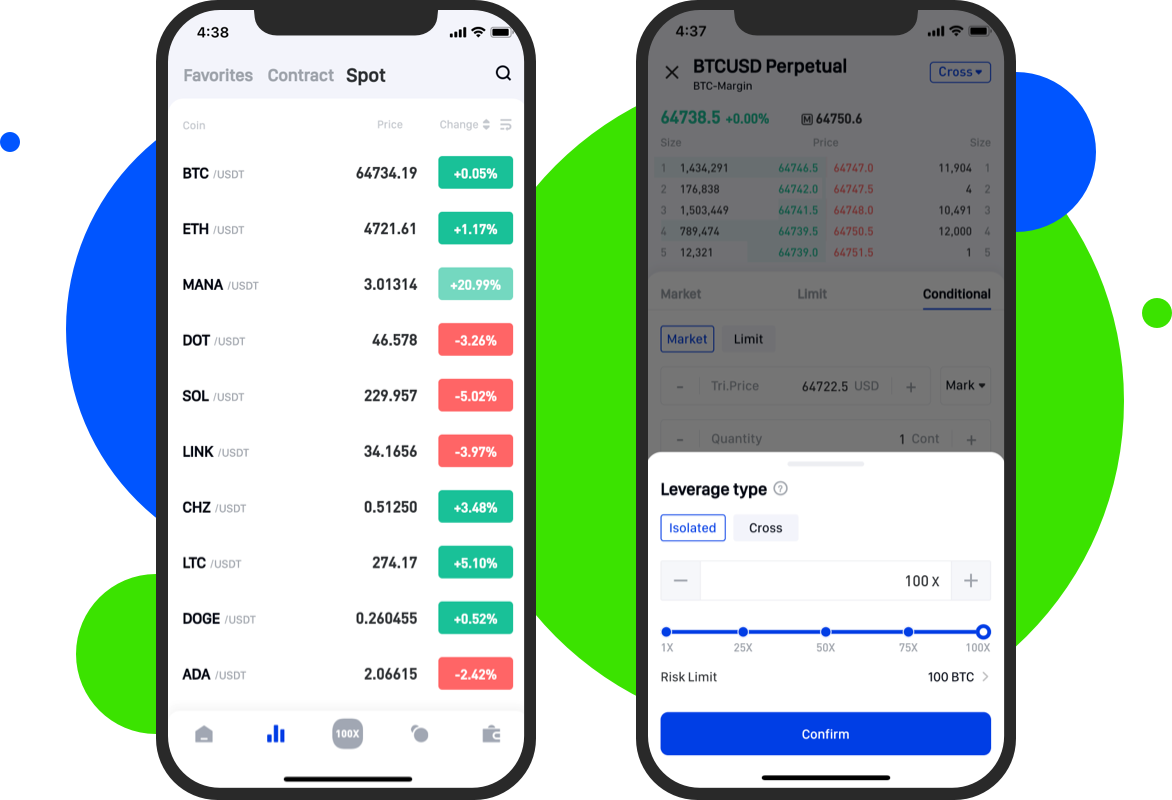

What is Crypto Trading?

Image Source: Link

Crypto trading is the process of buying and selling cryptocurrencies. Cryptocurrencies are virtual tokens that use cryptography to secure their transactions and control the creation of new units. Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control.

Cryptocurrencies are often traded on decentralized exchanges. A decentralized exchange is an online platform that does not rely on a third-party service to hold customer assets or to provide liquidity.

Cryptocurrencies can also be traded on centralized exchanges, which are operated by traditional financial institutions. Centralized exchanges allow users to trade cryptocurrencies with each other through a centralized marketplace.

Cryptocurrency trading can be risky, but it has the potential for high returns. You should do your research before investing in crypto trading and always remember that you should only invest what you can afford to lose.

How to Trade Crypto?

Image Source: Link

Crypto trading is a very popular investment strategy these days. It can be a great way to make money if you know how to do it. Here are some things you need to know about crypto trading:

- Cryptocurrencies are digital or virtual tokens that use cryptography for security. Bitcoin, the first and most well-known cryptocurrency, was created in 2009.

- Cryptocurrencies are decentralized, meaning they are not subject to government or financial institution control. This makes them attractive to some investors because they believe they are less likely to be manipulated or devalued.

- Unlike traditional currencies, cryptocurrencies are not backed by any tangible assets, such as gold or diamonds. This means that their value is based on trust in the cryptography that underlies them and the willingness of people to trade them.

- If you want to invest in cryptocurrencies, you will need a digital wallet where you can store your coins. There are many different wallets available, but some of the most popular include Coinbase and Exodus. You will also need an exchange where you can buy and sell cryptocurrencies. The most popular exchanges include Coinbase Pro and Binance.

Benefits of Crypto Trading

Image Source: Link

Crypto trading is growing in popularity, with many people believing the benefits outweigh the risks. Here are four key benefits of crypto trading that should convince you to give it a try.

- Greater liquidity: With so many different cryptocurrencies available, there is always a large volume of trading going on. This means that you can trade with confidence, knowing that your assets will be quickly and easily sold if needed.

- Reduced fees: Cryptocurrency trades are usually conducted through exchanges, which charge fees for their services. By using a cryptocurrency broker, you can avoid these fees and enjoy greater profit potential.

- Increased security: Cryptocurrencies are unique in that they are not regulated by governments or banks, meaning they are more secure than traditional currencies. This makes them a less risky investment option overall.

- Greater flexibility: With so many different cryptocurrencies available, you can tailor your investment portfolio to suit your specific needs and preferences. This gives you greater control over your financial future, something that is hard to find in traditional investments.

Risks Associated with Crypto Trading

Image Source: Link

Crypto trading is a high-risk activity, and there are a number of risks you must be aware of if you decide to get involved. These risks include the potential for theft and loss, as well as market volatility. If you are not comfortable with these risks, then you should avoid trading cryptocurrencies.

The first risk associated with crypto trading is theft. Cryptocurrencies are digital assets, and as such, they are susceptible to theft. If your cryptocurrency is stolen, there is a risk that it will be used without your knowledge or permission. This can lead to financial losses, as well as damage to your reputation.

The second major risk associated with crypto trading is market volatility. Cryptocurrencies are highly volatile, and this volatility can lead to significant financial losses. For example, if you buy Bitcoin at $10,000 and the price falls to $8,000 two weeks later, your investment has decreased in value by 50%. This type of volatility is inherent in all cryptocurrencies, and it is something that you should be prepared for if you decide to trade them.

If you are interested in trading cryptocurrencies, then it is important that you understand the risks involved. You should also make sure that you have appropriate insurance in the event of theft or market volatility – to protect yourself.

Conclusion

Cryptocurrencies are quickly becoming one of the most popular investment options on the market. But before you dive in, it’s important to understand some key things about crypto trading. In this article, we’ll cover everything from what cryptocurrencies are to how they work and why they’re so volatile. Armed with this information, you’ll be ready to start investing in crypto without any fear!